|

Webinar on GST Audit - Panel discussion on issue relating to GSTR 9C |

| Posted Date : 13-Aug-2019 , 11:20:21 | Posted By : CASANSAAR |

CA Sansaar is going to organise...

Webinar on GST Audit - Panel Discussion on issue related to GSTR 9C (Repeat Telecast) on 17th August, Saturday, 03:30pm to 6:30 pm.

By Reputed & Learned Faculty:-

*CA Gaurav Gupta,*

*CA Rahul Jain*

*CA Mansi Vohra*

Can participate in the webinar through your Mobile / Tablet / Laptop / Desktop as per your convenience.

Salient features of the Webinar

Understanding of legal provisions

Live Demo to file GSTR-9C

How to fill correct form

How to report on non compliance by Tax Payers.

Coverage of all technical and difficult aspects of GSTR-9C

Auditor Liability with respect to GST Audit and recommendations.

How to report when no proper records available.

Impact of GSTR 9 additional data on GSTR 9C.

Can ask queries by WhatsApp or by mail before or during the Webinar.

Recorded video lecture for future use

PPT for better understan |

| |

| Continue Reading... |

|

Category :

CA| Hits: 1405 |

|

|

|

Webinar on Annual Return (GSTR9) - Panel Discussion on issue related to GSTR 9 |

| Posted Date : 13-Aug-2019 , 11:13:55 | Posted By : CASANSAAR |

CA Sansaar is going to organise...

Webinar on Annual Return (GSTR9) - Panel Discussion on issue related to GSTR 9 (Repeat Telecast) on 16th August, Friday, 03:30pm to 6:00 pm.

By Reputed and Learned Faculty

*CA. Kuldeep Sharma

*CA. Rahul Jain

*CA Vaishali Agarwal

Can participate in the webinar through your Mobile / Tablet / Laptop / Desktop as per your convenience.

Salient features of the Webinar

Understanding of legal provisions

Demo to file GSTR-9

How to fill correct form

How to shown difference in GSTR 3B vs 2A vs accounts books ( outward / Inward)

Coverage of all technical and difficult aspects of GSTR-9

How to compile data of books, GST return for GSTR 9 to file error free GSTR 9

How to shown additional liability through GSTR 9

Impact of GSTR 9 additional data on GSTR 9C.

Recorded video lecture for future use

PPT for better understanding.,

Limited Seats Availabil |

| |

| Continue Reading... |

|

Category :

CA| Hits: 1188 |

|

|

|

Inner Healing Meditation Programme - Spiritual Tour to Mathura / Vrindavan |

| Posted Date : 04-Aug-2019 , 10:03:21 | Posted By : CASANSAAR |

Due to unavoidable circumstances, Tour has been postponed.

Art and healing gives us the ability to journey inward into the place of our own creativity

Time heals if you let it

Are u tired with GST Returns, Audits, Taxation ???

Forget everything and join inner healing program

Two days Spiritual Tour To Mathura / Vrindavan to spend a good bit of time in a quiet place to pray for inner healing.

Inner healing is an ancient science used to uplift human life from multiple limitations. It works magically and liberate us from various weaknesses we as human being encounter in our day to day life.

The inner Healing would be conducted by Acharya Manmohan Chitransh Ji, founder of Gyan Vigyan Yog. He is a highly evolved spiritual soul and has made difference in thousands of life through his immense knowledge and spiritual powers.

- Departure from Delhi - 17th August 2019, 06:00 AM (Luxry AC 2 |

| |

| Continue Reading... |

|

Category :

CA| Hits: 5582 |

|

|

|

Webinar on BlockChain - Opportunities and Challenges for Professionals |

| Posted Date : 04-Aug-2019 , 07:17:29 | Posted By : CASANSAAR |

CA Sansaar is going to organise...

Webinar on BlockChain - Opportunities and Challenges for Professionals -

By Reputed and Learned Faculty

*CA. Shailesh Churiwala

*CA. Vivek Khurana

On 10th August 2019, Saturday, 04:30 pm to 6:30 pm.

Can participate in the webinar through your Mobile / Tablet / Laptop / Desktop as per your convenience.

Salient features of the Webinar

What is blockchain?

Why is everybody talking of blockchain?

Busting the myths related to blockchain.

Why should a professional get into it?

Opportunities and Challenges for Professionals.

Recorded Video Lecture for future use..

Limited Seats Availability, First cum First Serve.

Fees :- Rs. 300/- only.

CLICK ON THE LINK FOR PAYMENT.

UPI / BHIM / PAYU / Wallets

CREDIT CARD

DEBIT CARD

NET BANKING

WALLETS

NEFT/BANK TRANSFER

OR PayTm No. 9899681022

Plz send us confirmation at info@ |

| |

| Continue Reading... |

|

Category :

CA| Hits: 11471 |

|

|

|

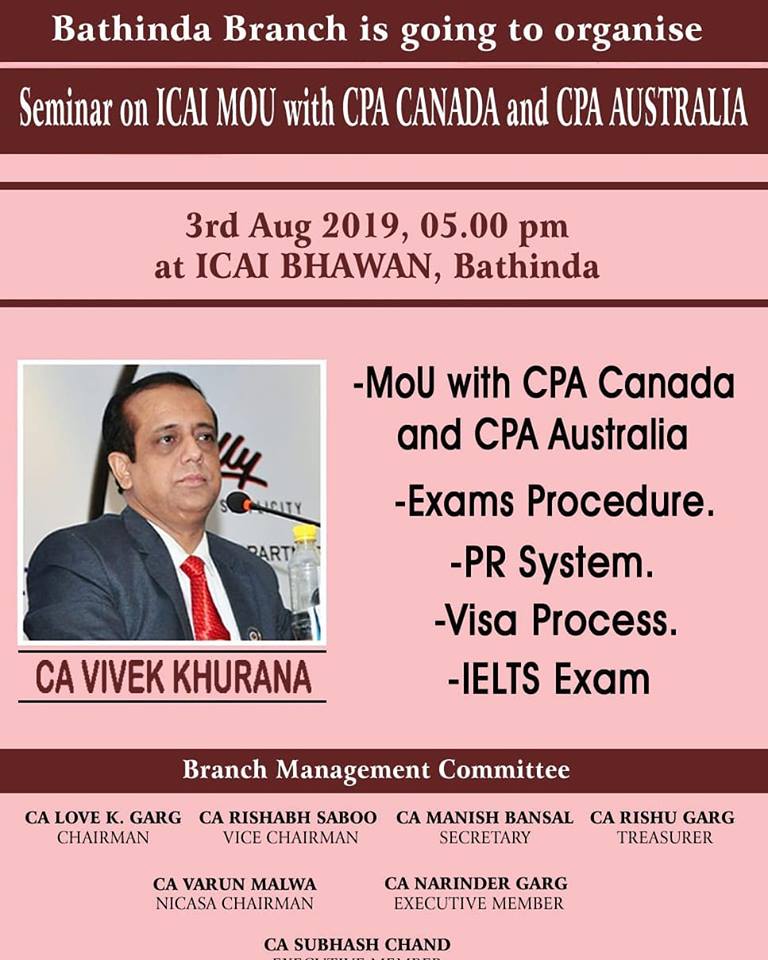

Seminar on ICAI MoU with CPA Australia and CPA Canada |

| Posted Date : 02-Aug-2019 , 12:01:17 | Posted By : CASANSAAR |

Please Join for 3 Hours CPE Seminar on ICAI MoU with CPA Canada and Australia. Exams procedure, PR System, Visa Process, IELTS / PTE at ICAI BHAWAN Bathinda as on 3rd August 2019 (Saturday)

Keynote Speakers:

CA Vivek Khurana Ji

Founder - casansaar.com

CPE HOURS : 3 Hours

Time: 05.00 pm - 08.00 PM

Fee for Members : Rs 300

Fee for Students : Rs.250

Followed By dinner

This discussion is for CA Members & Students only.

Warm Regards

Chairman & Team Bathinda branch of NIRC of ICAI |

| |

| Continue Reading... |

|

Category :

CA| Hits: 737 |

|

|

|

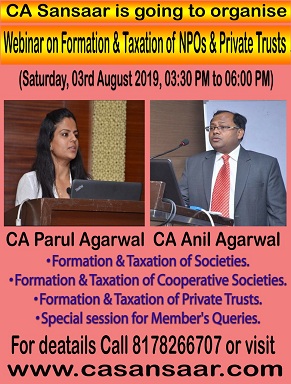

Webinar on Formation and Taxation of NPOs & Private Trusts |

| Posted Date : 29-Jul-2019 , 07:18:42 | Posted By : CASANSAAR |

CA Sansaar is going to organise...

Webinar on Formation and Taxation of NPOs & Private Trusts

By Reputed and Learned Faculty

*CA. Anil Agarwal

*CA. Parul Agarwal

On 3rd August 2019, Saturday, 03:30 pm to 6:00 pm.

Can participate in the webinar through your Mobile / Tablet / Laptop / Desktop as per your convenience.

Salient features of the Webinar

Formation & Taxation of Societies.

Formation & Taxation of Cooperative Societies.

Formation & Taxation of Private Trust.

Special session for Member's Queries.

(Send queries in advance at info@casansaar.com)

Recorded Video Lecture for future use..

Limited Seats Availability, First cum First Serve.

Fees :- Rs. 300/- only.

CLICK ON THE LINK FOR PAYMENT.

UPI / BHIM / PAYU / Wallets

CREDIT CARD

DEBIT CARD

NET BANKING

WALLETS

NEFT/BANK TRANSFER

OR PayTm No. 9899681022

Plz send us conf |

| |

| Continue Reading... |

|

Category :

CA| Hits: 2539 |

|

|

|

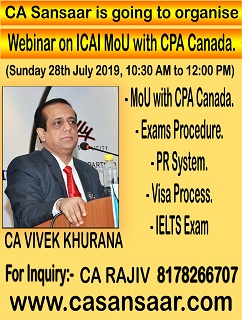

Webinar on ICAI MoU with CPA Canada by CA Vivek Khurana |

| Posted Date : 21-Jul-2019 , 10:59:13 | Posted By : CASANSAAR |

After overwhelming response and on the request of Members.

CA Sansaar is going to organise Webinar on ICAI MoU with CPA Canada (Repeat Telecast) on Sunday, 28th July 2019, 10:30 AM to 12:00 PM by CA. Vivek Khurana.

Can participate in the webinar through your Mobile / Tablet / Laptop / Desktop as per your convenience.

Salient features of the Webinar

- Procedure of CPA Canada

- ICAI MoU with CPA Canada.

- Exams Procedure / Exemption for Members of ICAI

- PR System of Canada

- VISA Process of Canada

- IELTS Exam

Fees :- Rs. 600/- only.

(No Fees who are already registered and want to join it again)

CLICK ON THE LINK FOR PAYMENT.

UPI / BHIM / PAYU / Wallets

CREDIT CARD

DEBIT CARD

NET BANKING

WALLETS

NEFT/BANK TRANSFER

OR PayTm No. 9899681022

Plz send us confirmation at info@casansaar.com with your Name, Memberip No., Place and Contact No.

WILL SHARE YOU ID AND LINK OF THE WEBINAR ON MAIL.

|

| |

| Continue Reading... |

|

Category :

CA| Hits: 3475 |

|

|

|

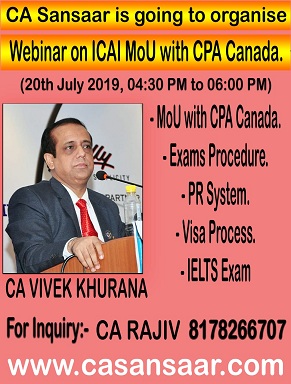

Webinar on ICAI MoU with CPA Canada by CA Vivek Khurana |

| Posted Date : 16-Jul-2019 , 09:59:40 | Posted By : CASANSAAR |

On the request of Members.

CA Sansaar is going to organise Webinar on ICAI MoU with CPA Canada on Saturday, 20th July 2019, 04:30PM to 06:00PM by CA. Vivek Khurana.

Can participate in the webinar through your Mobile / Tablet / Laptop / Desktop as per your convenience.

Salient features of the Webinar

- Procedure of CPA Canada

- ICAI MoU with CPA Canada.

- Exams Procedure / Exemption for Members of ICAI

- PR System of Canada

- VISA Process of Canada

- IELTS Exam

Fees :- Rs. 600/- only.

CLICK ON THE LINK FOR PAYMENT.

UPI / BHIM / PAYU / Wallets

CREDIT CARD

DEBIT CARD

NET BANKING

WALLETS

NEFT/BANK TRANSFER

OR PayTm No. 9899681022

Plz send us confirmation at info@casansaar.com with your Name, Memberip No., Place and Contact No.

WILL SHARE YOU ID AND LINK OF THE WEBINAR ON MAIL.

For Details Contact CA Rajiv at 8178266707 or Mritunjaya at 8285393786 or Abhi at 7678359687 |

| |

| Continue Reading... |

|

Category :

CA| Hits: 6375 |

|

|

|

Webinar on ICAI MoU with CPA Australia by CA Vivek Khurana |

| Posted Date : 26-Jun-2019 , 10:26:03 | Posted By : CASANSAAR |

After overwhelming response and on the request of Members.

CA Sansaar is going to organise Webinar on ICAI MoU with CPA Australia (Repeat Telecast) on Saturday, 29th June 2019, 04:30 PM to 06:00 PM by CA. Vivek Khurana.

Can participate in the webinar through your Mobile / Tablet / Laptop / Desktop as per your convenience.

Salient features of the Webinar

- Procedure of CPA Australia

- ICAI MoU with CPA Australia.

- Exams Procedure / Exemption for Members of ICAI

- PR System of Australia

- VISA Process of Australia

- IELTS / PTE

Become Member of CPA Australia by giving just two online exams in India within minimum period of 3-6 months.

Fees :- Rs. 500/- only.

CLICK ON THE LINK FOR PAYMENT.

UPI / BHIM / PAYU / Wallets

CREDIT CARD

DEBIT CARD

NET BANKING

WALLETS

NEFT/BANK TRANSFER

OR PayTm No. 9899681022

Plz send us confirmation at info@casansaar.com with your Name, Memberip No., Place and Cont |

| |

| Continue Reading... |

|

Category :

CA| Hits: 1135 |

|

|

|

Groom yourself as Speaker - Two Days Program for Speakers |

| Posted Date : 26-Jun-2019 , 10:12:55 | Posted By : CASANSAAR |

Due to some unavoidable circumstances, Event has been postponed. New Dates will be announced Shortly.

Can you speak on any subject like GST, Income Tax, International Taxation, Companies Act, FEMA, Bank Audit, IBC or any other subject???

CASANSAAR is going to give you a big platform to show your talent and will also groom up new speakers.

CASANSAAR is going to organised 2 days (Fri -Sat or Sat -Sun) program on 12-13th July 2019 for new speakers at Institute of Engineers, I.P Marg, ITO, New Delhi (Near ICAI Bhawan), Where we will give time to every speaker to speak in front of Judges and they will judge your performance and further guide you if required.

Recording will be there and also telecast online / offline on social media.

Speakers will get chance for our seminars, webinar, you tube and also for our residential tour / Seminars / Webinars / Programs. Best 2-3 Speakers will get chance to speak in the international seminar of CASANSA |

| |

| Continue Reading... |

|

Category :

General| Hits: 1923 |

|

|

|

|